UnitedHealth Group (UNH) Appoints Wayne S. DeVeydt As New CFO Effective September 2025

'豆瓣小组'寻找志同道合的趣图分享:douban.com/group/dailyfun #生活乐趣# #日常生活趣事# #日常趣图#

UnitedHealth Group (UNH) recently announced a leadership transition with Wayne S. DeVeydt set to become the new CFO, replacing John F. Rex, which highlights the company's forward-looking approach in navigating the healthcare landscape. Despite this executive change, UNH's share price experienced a 10% decline last week, likely influenced by broader market turbulence driven by global trade uncertainties and a weak U.S. jobs report. Additionally, a decrease in the company’s Q2 net income and EPS may also have added pressure. Overall, the decline in UNH's stock could be seen as part of broader market movements amid economic concerns.

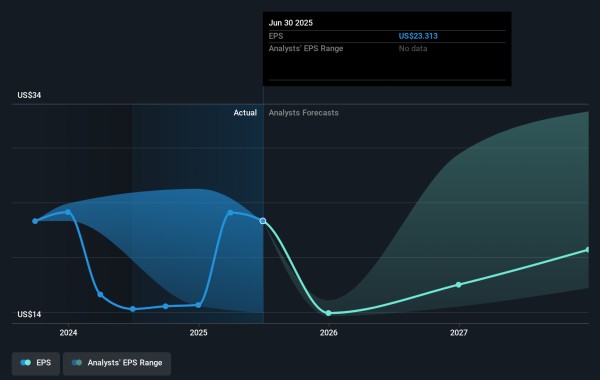

UNH Earnings Per Share Growth as at Aug 2025

UNH Earnings Per Share Growth as at Aug 2025 The leadership change at UnitedHealth Group marks a significant development in its strategy to adapt to the evolving healthcare landscape. Although the immediate market reaction resulted in a 10% decline in share price, the company's efforts to revise Medicare strategies and enhance digital tools may counterbalance these impacts. This shift could stabilize revenues and improve operational efficiency amid broader market concerns.

Over the past five years, UnitedHealth Group's total shareholder return, including dividends, was a 14.25% decline. In comparison, the company underperformed the U.S. market, which saw a return of 16.8% over the last year, and fell short against the U.S. healthcare industry, which returned 36% over the same period. This relative underperformance calls for a closer examination of the company's strategic initiatives and their projected outcomes.

The recent announcement may influence revenue and earnings forecasts, especially given its proactive adaptation in Medicare and predictive care models. Analysts anticipate a growth in earnings to US$24.4 billion by July 2028, with revenue projected at US$515.40 billion. However, potential risks remain, such as external funding pressures or execution challenges with the new CMS risk model, which could impact net margins and earnings.

Currently trading at US$249.56, UnitedHealth Group's share price remains significantly below the consensus price target of US$336.63. The substantial gap between the current price and the target suggests potential upside, reflecting differing analyst expectations and the company's long-term strategic adjustments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

网址:UnitedHealth Group (UNH) Appoints Wayne S. DeVeydt As New CFO Effective September 2025 https://klqsh.com/news/view/105078

相关内容

UnitedHealth names Wayne DeVeydt as new CFOSean 'Diddy' Combs sex trafficking trial begins as rapper accused of '20 years of crime'

Role of sclerostin in bone and cartilage and its potential as a therapeutic target in bone diseases

New Mexico

Sean ‘Diddy’ Combs sex trafficking trial begins in New York: Here’s what to know

CALABARZON (Region IV‑A) Profile – PhilAtlas

GloRilla & Friends 1st Annual GLO BASH

Jury selection in Sean 'Diddy' Combs' sex trafficking trial begins today

Why Katy Perry and Orlando Bloom Split After 7 Years Together

Fit Testing